How To Change R350 Payment From Post Office To Bank You can change your sassa payment method from Post office to Bank Account follow the Steps and simple procedures provided on this page.

Why Change Your Payment Method?

Changing your payment method from the Post Office to a bank account can offer several benefits:

-

- Convenience: Access your money directly without needing to travel to the Post Office.

-

- Security: Keeping your funds in a bank account can reduce the risk of theft and fraud.

-

- Speed: Bank transfers may be processed faster than cash withdrawals from the Post Office.

Available Payment Options for South Africans and Asylum Seekers

Currently, three payment methods are available for SRD grant recipients:

1. Bank Account: Payments are deposited directly into your nominated bank account, offering convenience and security.

2. Post Office (SAPO): You can collect your grant in cash at any participating post office across South Africa.

3. Cash Send: You should also understand: how to change the sassa r350 payment method to cash send. This option allows you to collect your grant in cash at approved retail outlets nationwide.

Asylum seekers and special permit holders currently have limited payment options and can only receive their grants through the Post Office or Cash Send. Bank account payments are unavailable for these groups at this time.

How to Change Your SRD Grant Payment Method to Sassa

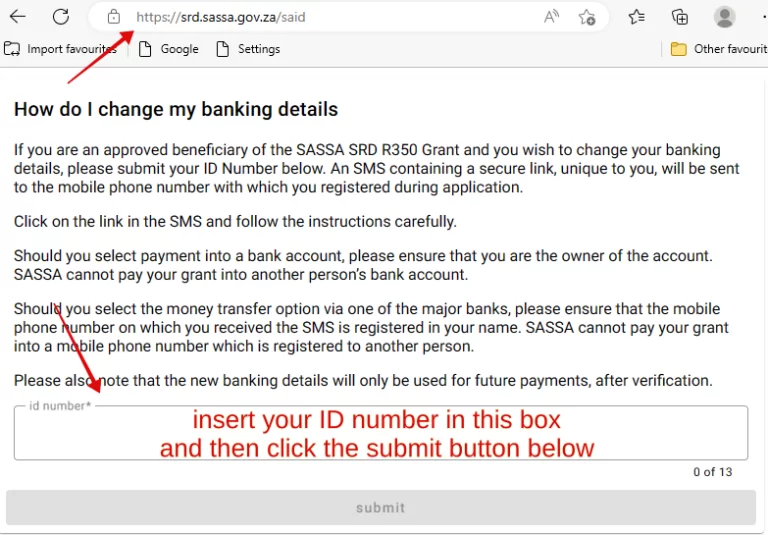

You can change your SRD grant payment method online. Visit the official SASSA website.

Observe the following process:

Visit the website: Open the official SASSA SRD website. Here you will select the right option according to your ID type.

Verify your identity: Enter your ID number and mobile number. Now click, on Continue. You can get an SMS with a verification code on your phone. Enter the code to proceed.

Go to Change Banking Details: Now search the Change Banking Details section or a similar option on the dashboard.

Select your preferred method: You have two choices here. Choose either Bank Details or Cash Send/Post Office. The first is for bank deposits and the other is for cash withdrawals.

Enter your details: Carefully fill in the required information. It depends on your chosen method. For bank deposits, send all your details such as bank name, account number, and branch code. For Cash Send/Post Office, select your preferred location.

Review and submit: Double-check all your information for accuracy before submitting the request.

Verification and Waiting Period

Verification: Wait for 7 business days for verification. You will get an SMS notification confirming the status of your request.

Waiting period: Once approved, it may take another 5-7 business days. This time is consumed in activating your chosen payment method. The first payment after a change might be delayed.

Additional Information

To choose the right payment method for your SRD grant follow the steps carefully. By selecting the right payment mode, you can receive your financial assistance conveniently and securely.

How to Avoid Delays in Approving Your Updated Bank Details

Here are some tips to avoid delays in approving your updated bank details for the SRD grant:

SASSA Grant Payment To The Supermarket Money Account or to the Bank Account: Which is Better?

Both switching to a bank account and switching to a supermarket money account (like Shoprite Money Market) offer benefits compared to traditional methods like Post Office or Cash Send collections. However, the specific benefits differ depending on your needs and the specific account you choose.

Benefits of Switching to a Bank Account

Benefits of Switching to a Supermarket Money Account (Specific to Shoprite Money Market)