HOW TO SUBMIT YOUR SARS TAX RETURN ONLINE USING eFILING Get Complete Guide tO SUBMIT YOUR SARS TAX RETURN ONLINE USING eFILING all steps we explained in this article.

How to use SARS eFiling to File Income Tax Returns

STEP 1: Get started by logging in

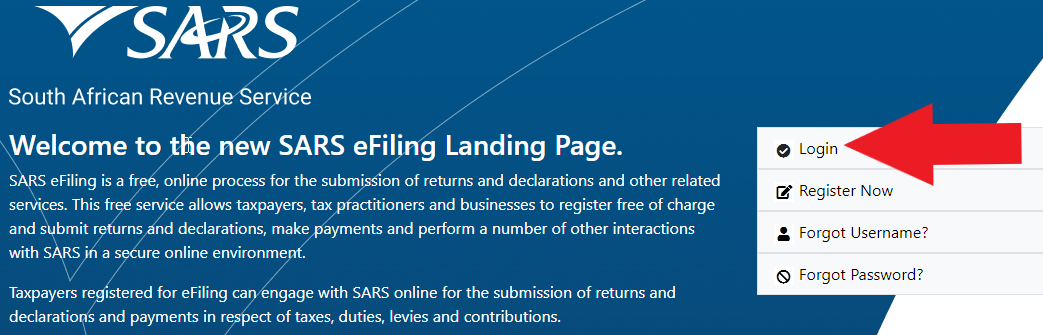

Go to www.sarsefiling.co.za.

On the right hand side of the screen you will see Log in, please click this option.

Then type in your unique username, click next and thereafter type in your password – you will have decided on these when you registered for eFiling. Then press login.

Didn’t register yet to eFile? See how to register for SARS eFiling step-by-step

If you used to use a tax practitioner and they did this for you, you should request your SARS eFiling login details from them – they belong to you.

Otherwise call SARS ZA on 0800 00 7277 (0800 00 SARS), provide your ID number and some other security details and they will restore access to your eFiling.

STEP 2: Generate your ITR12 tax return

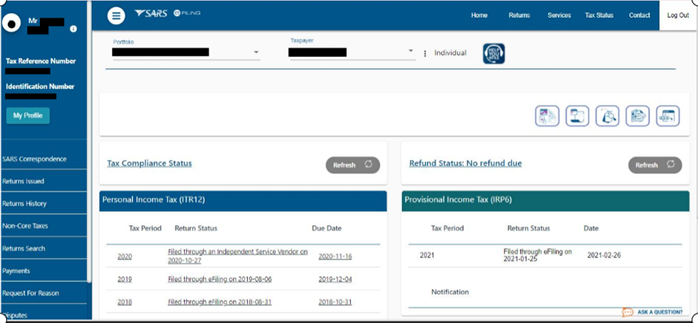

Make sure that your name appears at the top under Taxpayer List just in case you have logged onto someone else’s SARS eFile page.

If the title of the page is not INCOME TAX WORK PAGE then click the RETURNS ISSUED button in the menu on the left hand side.

In the menu on the left Returns Issued will open, showing Personal Income Tax (ITR12) – click Personal Income Tax (ITR12).

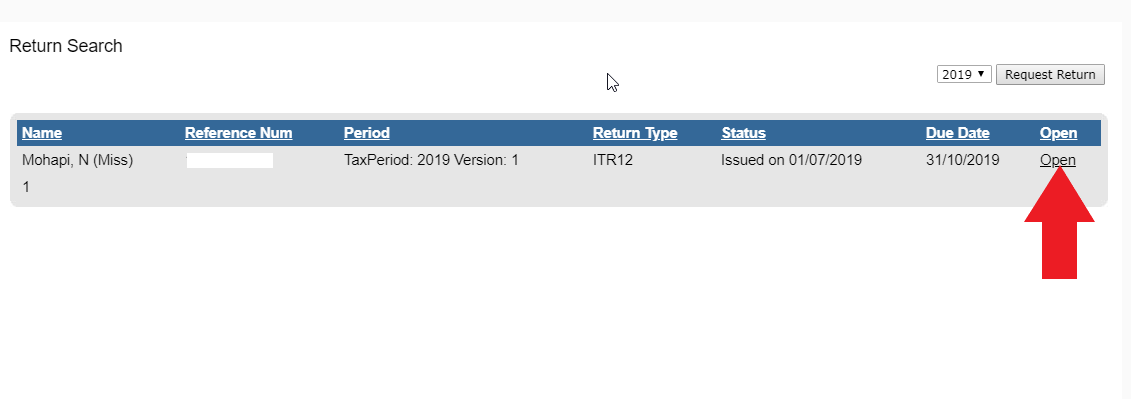

Once you’ve followed all the steps, the page title will now be Return Search and should show the ITR12 returns you are busy with.

If you have already created your income tax return for the relevant year (it should be listed), jump to STEP 3 below.

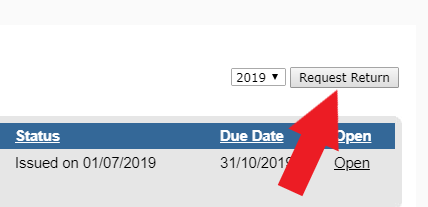

Otherwise, select a tax year from the drop down selector box on the right hand side of the page and click Request Return. This tells SARS you would like to complete a return for that year and they generate it for you.

STEP 3: Start work on your income tax return

In the long blue box you will see the requested return showing your name, reference number, return type, status and due date. Click Open on the right hand side.

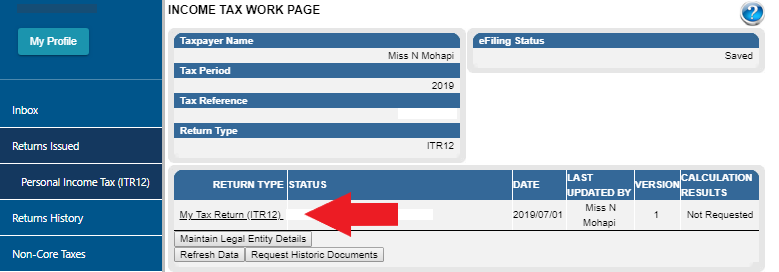

After reading the information pop-up (important info!), you will then find yourself on the INCOME TAX WORK PAGE of SARS eFiling.

This page summarises your tax return for the year.

Under return type, click ITR12. Note the Tax Period matches the tax season you are filing for.

Depending on your browser this will either open in a new window or tab and may take a while to load fully.

STEP 4: Using the Wizard to setup the sections of your return

You have finally gotten to your actual tax return!

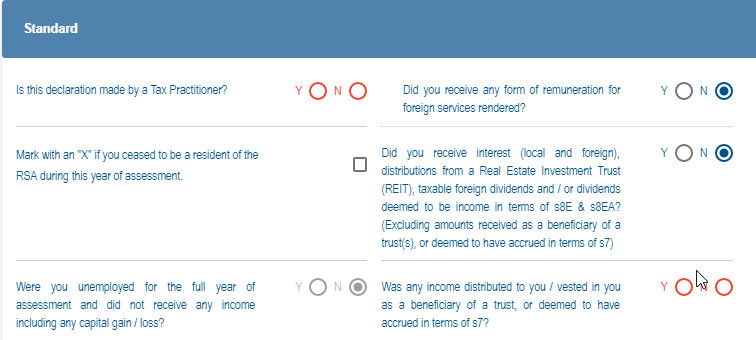

The very first page of your return on eFiling asks you a couple of questions in order to build a return that is specific to you personally.

For example, it will ask how many IRP5s you received from your employer, then the return that is generated will show that number of IRP5s on it for you to complete.

It will start out looking like this:

Then once you start filling it out – checking boxes and entering numbers – it will change, prompting you for more information.

STEP 5: Complete your return in eFiling

WARNING: Filling out your tax return without help can result in you paying too much tax, or getting a lower tax refund. Let TaxTim complete and submit your tax return in 20 minutes or less. It’s easy!

STEP 6: Submit and you’re done!

You can return to this page any time you like, click on your ITR12, make changes and save.

If you’re 100% happy, don’t click Save Return, click File Return and it’s done – you just got tax compliant all on your own!

If there is a pop-up, read it – you may have left something out!

What happens next???